Your Zeffy Tax Guide

We’re simplifying the 2025 tax season for you by preparing a comprehensive guide with the essential information you need.

Zeffy will re-send a summary of your donors' 2025 tax receipts by January 31st, 2026.

By January 31st, 2026 all of your donors from 2025 that were eligible for a tax receipt will have received their tax receipts via email.Zeffy is not generating receipts on your organization's behalf. We are resending receipts that have already been issued to donors, including the cumulative receipts issued for monthly donations.

If you do not generate receipts in Zeffy, your donors will not receive a receipt from Zeffy for their donations.

What information is Zeffy sharing with my donors?

The email sent from Zeffy will include a link to a webpage that displays the donor's giving recap. On this page, they can download each of your donor’s receipts for payments made through Zeffy in 2025.

Donors are also able to access their giving recap and all of their donation receipts from their Zeffy donor account. Click here to learn how to direct your donors to their Zeffy donor account.

What is the Zeffy Giving Recap page?

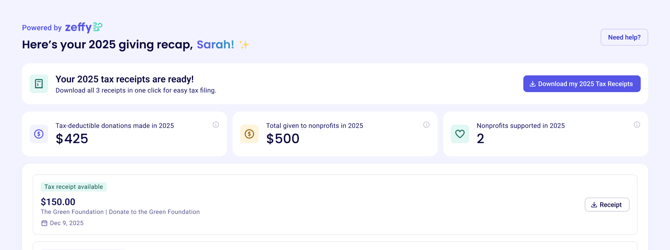

The Zeffy giving recap page includes information and receipts from all Zeffy organizations this donor gave to, ensuring that they can access all of their 2025 tax receipts in one place.

This page includes: all tax receipts (one-time, partial, cumulative, automatic and manual), a summary of the total they have donated, the number of organizations they have supported and a breakdown of all transactions.

Specifications on the tax receipts included:

- For one-time donations

- If generated automatically, donors will have already received a copy of the tax receipt in their initial confirmation email. Zeffy is re-sending these receipts so they have them on hand for tax season.

- If one-time donation receipts were generated manually, whether they have been sent to the donor or not, they will be included in this email.

- For monthly donations, donors will receive one cumulative receipt for all eligible recurring donations made in 2025. This receipt will be automatically generated in January 2026 and sent by Zeffy.

- If automatic receipt generation was disabled for any part of the year on the form, only donations made during months when the option was enabled will be included in the cumulative receipt.

Here is a sample of the email donors will receive:

Here is a sample of the Giving Recap page

What your organization can do to prepare for the 2025 tax season:

1. Send an email to your donors in early January to notify them that Zeffy will be re-sending their tax receipts by January 31st, 2026. Learn more about Zeffy's emailing tool here.

2. Review your 2025 donation tax receipts and ensure they are up to date before January 20th, 2026. Correct any receipts that aren’t accurate and add all your offline donations for the year that you would like to emit receipts for. To learn how to edit and generate receipts, check out the following articles:

How to view a report of all receipts generated in Zeffy for 2025

You can export a report of all tax receipts generated by your organization in Zeffy.

- Navigate to the "Finances" > "Tax receipts" tab in your account.

- Filter by year with the quick filter option "Add a date range" > "2025".

- View the amount you’ve emitted in receipts for this year.

- Export your tax receipt report by pressing “Export 2025 tax report”.

Frequently asked questions by organizations:

Q: Can I opt-out of Zeffy resending tax receipts to my donors?

A: No, it is not possible to opt out of tax receipts being resent to donors. Donors will receive their receipts for all their donations through Zeffy, not just those made to your organization. We have a multitude of donors who have donations to multiple non-profits on the platform and the reminder email allows them to have them in one place without needing to contact us about missing receipts for only one non-profit or only one donation.

Q: When will my donors be receiving their tax receipts for their donations made to my organization? Do I need to send them out?

A: By the end of January 2026, your donors will receive an email from Zeffy which will include all tax receipts generated by January 20th 2026 and cumulative receipts for monthly donations which Zeffy will generate before sharing the link with donors.

Q: I need to quickly see the the amount my organization has emitted in receipts this year. How can I do this?

A: Under the "Finances" tab, in the "Tax receipts" tab, you’ll have access to all the receipts emitted for your organization through Zeffy. By filtering by the dates you need (quick tip use the quick filters like "Date range" > "2025"), you’ll be able to see all the receipts emitted during that time, along with the total amount emitted in receipts. We also provide the advantage amount in the case that you emitted split tax receipts.

How to answer your donors' frequently asked questions:

Q: When will I be receiving my tax receipt for my donation made to your organization?

A: By the end of January 2026, you will receive an email from Zeffy, the fundraising platform we use. They will be sending all of your tax receipts from all the organizations that you have given to that use Zeffy. This will include your tax receipt from our organization.

Q: Why are we getting this receipt again? I already have it!

A: This is just a reminder email in case you lost your receipt for a donation you have previously made. If you have already downloaded a copy previously, you can use that one.

Q: I want one receipt for all the donations I’ve made to your organization this year. Is that possible?

A: If you’ve made a monthly recurring donation, you’ll receive one receipt for all your payments related to this recurring donation.

If you’ve made multiple one-time donations, you’ve already received a receipt for each individual payment.

Since these documents have already been produced, we cannot emit a cumulative receipt. Zeffy will be sending one PDF document to you by the end of January 2026. This will include all your receipts, which you can use directly to submit your taxes or send to your accountant if applicable.

Q: Why is my monthly donation receipt dated December 30th?

A: Zeffy emits a cumulative receipt for your monthly giving and since you give multiple times a year, there is no exact date for your giving. Zeffy chooses to date the receipt at the end of the year to be inclusive of all donations, but that does not mean the payment was made on that date. We want to assure you that the receipt is eligible to be submitted.

Q: I am missing a tax receipt for a donation I made in 2025, why wasn't it sent to me?

A: We resend tax receipts for donations made in 2025 to the email address that was used to complete the transaction. Encourage donors to check all of their email inboxes to make sure it wasn't sent to a different one than the one they typically use.