Everything you need to know about advantage amounts

What does the "advantage amount" in Zeffy mean and what is its role in charitable donations?

What is the advantage amount?

In your Zeffy reports or tax receipts, you may come across the term "advantage amount." In short, an advantage amount, in the realm of charitable donations, refers to the portion of a payment that is not eligible for a charitable tax receipt. It is the value of any goods, services, or benefits that was received in return for a donation.

What will be admissible on a tax receipt?

The admissible amount for a donation with an advantage is the difference between the total amount donated and the value of the advantage received.

Amount eligible for a tax receipt = Total Payment - Advantage Value

The eligible amount is the amount for which the tax receipt will be issued.

Payments for which there might be an advantage amount

-

Scenario 1: In the settings of your event form, you have specified that a tax receipt should be issued for only a portion of the ticket price. For example, for a 50$ ticket purchase, a 20$ tax receipt should be generated. This would mean an advantage amount of 30$.

-

Scenario 2: You have activated the "additional donation" feature on your form. If the ticket is not eligible for a tax receipt but the extra donation is, the tax receipt will only be issued for the extra donation value. The advantage amount would therefore be the price of the ticket that is not eligible for a receipt.

How do I find the advantage amount in Zeffy?

There are multiple ways to view the advantage amount in Zeffy.

1. Export your payment data

In your account, go to the "payments" tab under ''fundraising'' on your left side menu and click on "+ filter" at the top. In the drop-down filter, select the event for which you want to export the sales. Once the filter has been applied, click on "export" in the top right.

In the exported file, you will see a column called "advantage amount" for each transaction, if applicable.

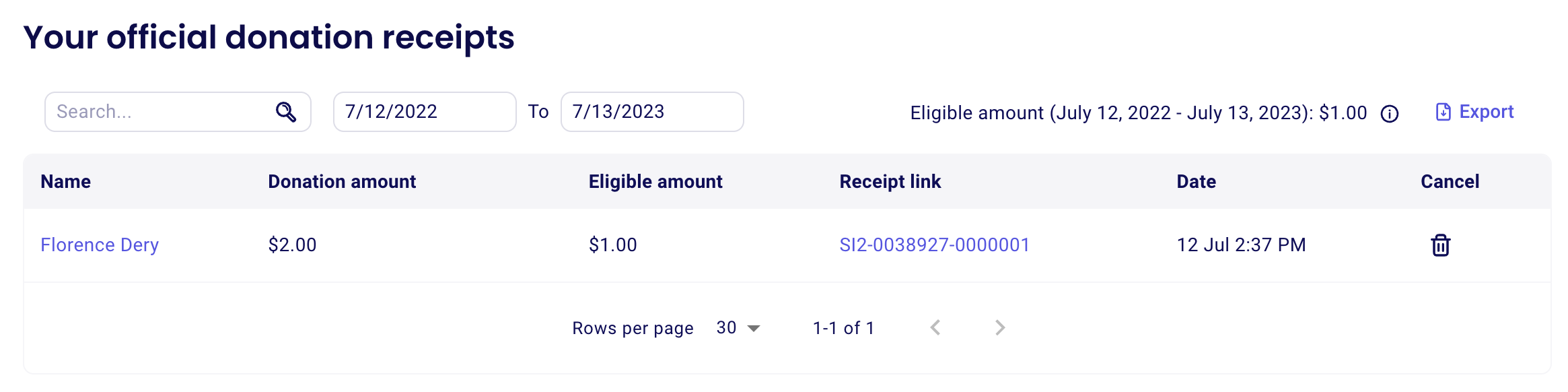

2. Take a look at your receipts page

In your account, go to "Fundraising" > "Tax receipts." There, you will find a column called "donation amount" which refers to the total payment value. The column "eligible amount" refers to the value of the tax receipt. The difference will be the advantage amount.

This information is also visible when clicking on "export" on the receipts page.

3. Take a look at the tax receipt itself

Under "Fundraising" > "Payments," you can click on any particular transaction and a page will open towards the right. If a tax receipt is associated with that purchase, you will be able to click on it to view the actual receipt. The tax receipt value and advantage amounts will be specified on the receipt itself.