Edit or cancel a tax receipt

Existing tax receipts cannot be edited, but here's how to cancel one and generate a new replacement one.

To cancel a tax receipt :

- Go to "Contacts" and find your donor using the search bar. Click on the donor's name to open their donor profile.

- Under the "Receipts" section of the donor profile, you'll find the list of all recent receipts generated for this donor. Hover your mouse over the receipt you wish to cancel, and click the "🚫" at the right of the page.

Once a tax receipt is canceled, a "Cancelled" mention will appear on the receipt. Your donor will also receive a notification by email that their tax receipt has been cancelled. Additionally, if your donor clicks the link in their original confirmation email to download their receipt, the "Cancelled" mention will automatically appear in real-time.

To generate a new replacement tax receipt :

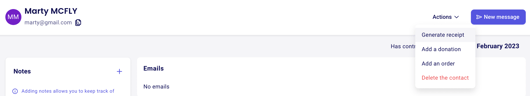

- Stay on the donor's profile, and click the "Actions" button at the top right on the page. Select "Generate receipt"

- A window will open, allowing you to create a new tax receipt. Fill in the donation amount, donation date, and donor information.

- You can add a note to the tax receipt that mentions "This receipt cancels and replaces receipt XXXXXXXXXXXX".

- Click "Generate" to add the receipt to the donor profile.

❗ Once a new receipt is generated manually, you must download the new tax receipt in a PDF format to send it to your donor by email, as it will not be sent automatically.