How can I set up partial tax receipts?

You can set up partial tax receipts in Zeffy for event sales, memberships, raffle tickets, and e-commerce forms.

Yu can set up partial tax receipts for an event or for items that you are selling. For example, if you have a charity dinner where the entry price is $50, but only $30 is eligible for a tax receipt, you can easily set this up.

Step 1: Make sure your account is set up correctly!

- Log into your Zeffy dashboard on a computer.

- Click on your name at the bottom lefthand corner of your dashboard. This goes to your settings.

🇨🇦 Canadian Accounts:

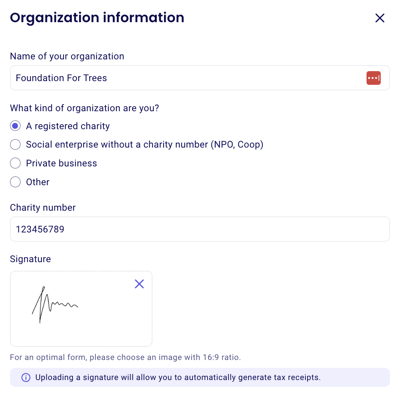

- 1️⃣ Click on "Organization Information": Make sure you have selected that you are a registered charity. Enter your charity number and upload the signature of someone who can represent your nonprofit.

- 2️⃣ Click on "Visual identity": Make sure to upload a logo.

💡 The signature is mandatory to generate tax receipts in your account.

🇺🇸 US Accounts:

- 1️⃣ Click on "Organization Information": Make sure you have selected that you are a 501(c)(3) organization. Enter your EIN and save your changes.

- 2️⃣ Click on "Visual identity": Make sure to upload a logo.

💡 The EIN number is mandatory to generate tax receipts in your account.

Step 2: Turn on automatic partial tax receipt generation on your form

- Go to "Campaigns" in the left-hand side menu and click on "Edit" to the right of the form for which you want to activate automatic tax receipts. (If you don't have a form yet, you can create one).

- Jump to the "Tickets" section of your form editor. Underneath each ticket type, there is a "See more options" button. Click on it to view the option to generate a receipt.

- Check the option to generate a tax receipt. You can now select the amount that is eligible for a tax receipt.

- Click "Save" in the top right-hand corner. You're all set! Tax receipts will be automatically generated and sent to donors when they make a purchase through this form.