How can I generate a manual tax receipt?

Easily generate a manual tax receipt.

➡️ Generate a receipt for an existing contact

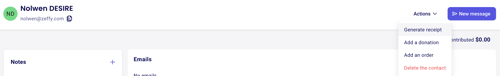

- Go to "Newsletter" > "Contacts" and click on the contact for whom you would like to generate a receipt.

- On their contact page, click on "Actions" and "Generate Receipt". Their information will be pre-filled, all you have to do is enter the donation amount.

💡 If a contact does not exist yet, you can add one in the "Contacts" section.

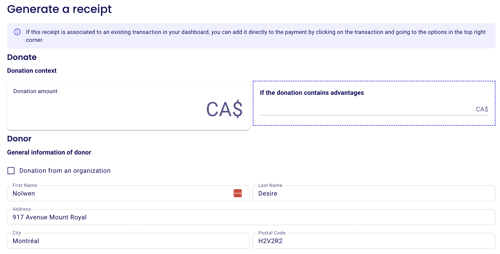

- From the contact page, all the information about this contact will already be entered.

Some useful tips:

- If this donation was made on behalf of an organization, check "Donation from an Organization". The name of the organization you indicate here will appear on the tax receipt.

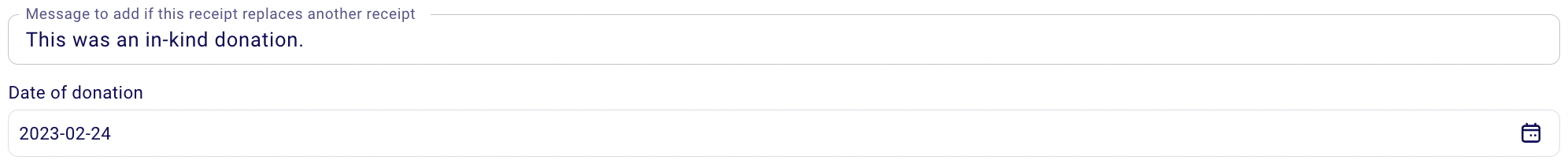

- If it is an in-kind donation, you can use the "Message to add if this receipt ..." as a note box. The text here will be displayed as a note on the receipt.

➡️ Retroactively generate a receipt for an existing payment

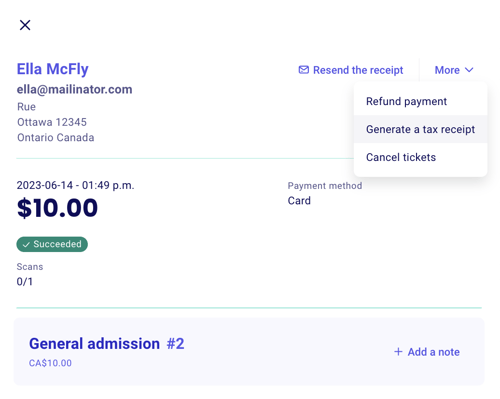

- Go to "Payments'' under ''Fundraising'' on your left-hand side.

- Click on the transaction in question, and a window will open on the right.

- Click on "more" in the top right, and from the drop-down menu, select "Generate a tax Receipt". This will allow you to generate a receipt for the payment in question.

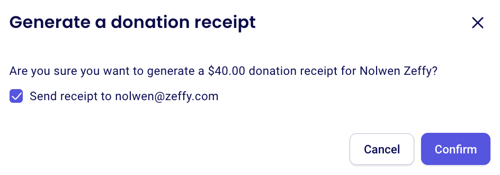

- A pop-up will open asking you to confirm the generation of this tax receipt. I you check the box "send receipt," the tax receipt will automatically be sent to the donor.

⚠️ You can also generate a tax receipt when manually adding a payment to your dashboard. To learn how to do this, take a look at the instructions here.