I am still waiting for my 501c3 or charity status, can I start using Zeffy?

If you are a registered nonprofit, but you're still waiting for your 501c3 or charity status, you can start using Zeffy. You can change the nonprofit type in your settings.

What type of nonprofit should I select during my onboarding?

US Accounts: Other nonprofit organization

When you create a Zeffy account, you will be asked to indicate what type of nonprofit your organization is registered as. If your organization is registered with the IRS, but you are still waiting for your 501c3 (or other 501c status), you can register as an "Other nonprofit organization."

When you obtain your official 501c status, you will be able to change your organization type in your settings.

Note: Your organization must have an EIN and a bank account open in your organization's name. It is required to be registered with the IRS to use Zeffy.

CAD Accounts: Social enterprise without a charity number (NPO, Coop)

If your organization is a nonprofit entity, but you are still waiting for your registered charity status from the CRA, you can register as an "Social enterprise without a charity number (NPO, Coop)"

When you obtain your official charity status, you will be able to change your organization type in your settings.

Note: Your Canadian organization must be a nonprofit and have a bank account open in your organization's name.

How to change your organization type when you obtain your 501c / registered charity status

1. Login to your Zeffy account

2. Click on your name in the bottom left corner of your dashboard and navigate to "Settings"

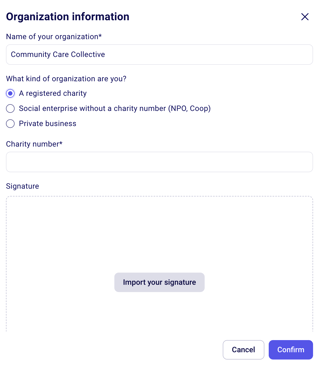

3. Select "Organization information" and change the nonprofit type

4. Complete the requested information:

- US Organizations: You will be asked to confirm your EIN in the organization information section so that it can be added to tax receipts. As a 501c organization, you can generate tax receipts automatically through the platform. Click here to learn more.

- Canadian Organizations: You will be asked to add your CRA charity number and you will have the option to upload an electronic signature to enable tax receipt generation on the platform. Click here to learn more.